UPD (September 2025):

If you have also been affected by the actions of Globiance — either through the crypto project or the fiat project GlobiancePay — we are currently collecting victim statements to be submitted to law enforcement authorities as part of an ongoing criminal case.We also invite current and former employees of the company to come forward with information or testimony. Confidentiality is guaranteed, and a reward is offered for valuable information that can support the investigation.

Contact us at main@affdragons.com.

For a detailed analytical investigation with evidence, regulatory analysis, and legal

qualification, see our comprehensive report: [Globiance/GlobiancePay: Analytical Report

on Signs of Financial Fraud]

Stories of financial frauds are no longer rare. We have seen OneCoin, Bitconnect, Africrypt — and the scheme is always the same. First come the loud promises, then “technical delays,” followed by long posts with excuses and promises of “future payouts.” And in the end — the money disappears. Today it is the story of Globiance and GlobiancePay, unfolding right now.

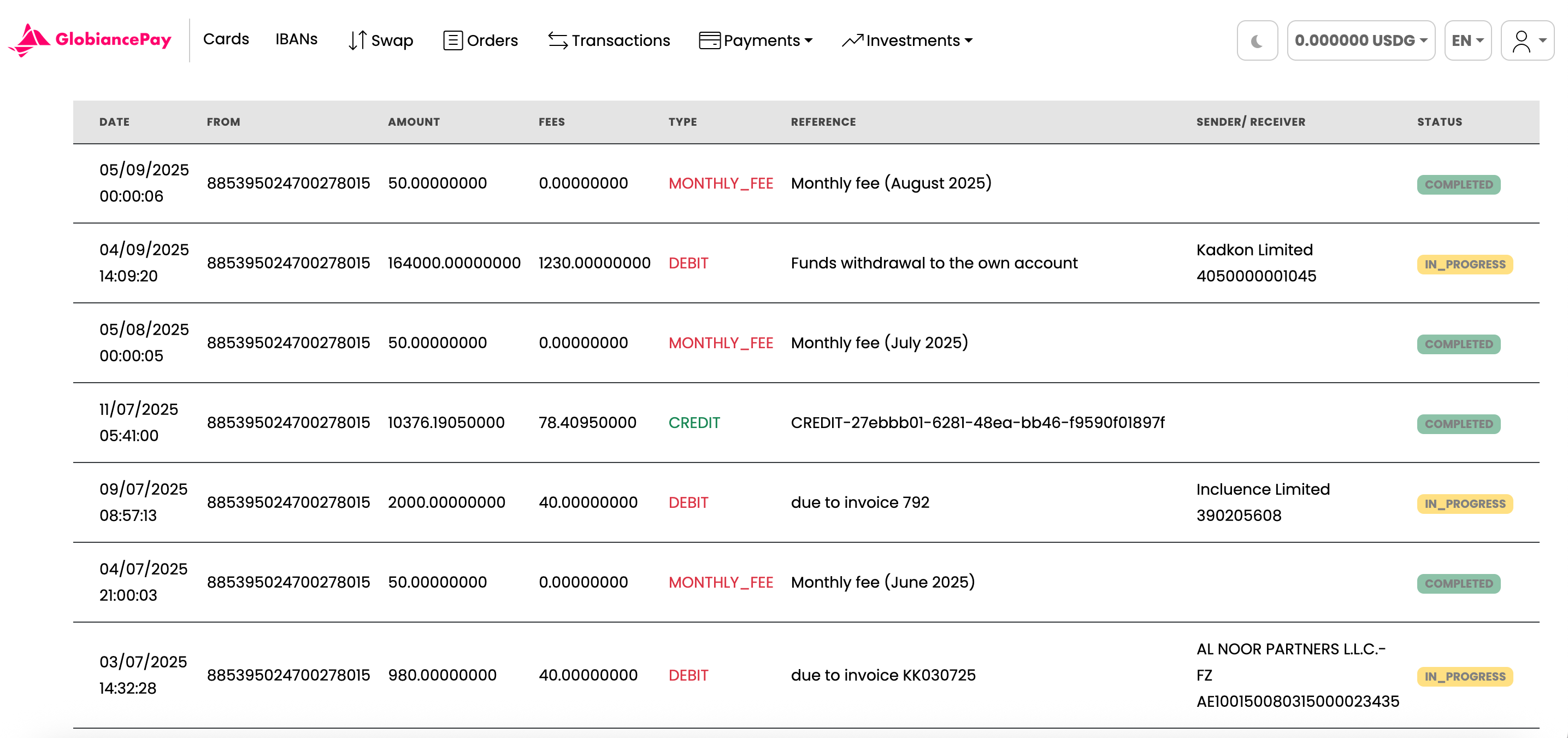

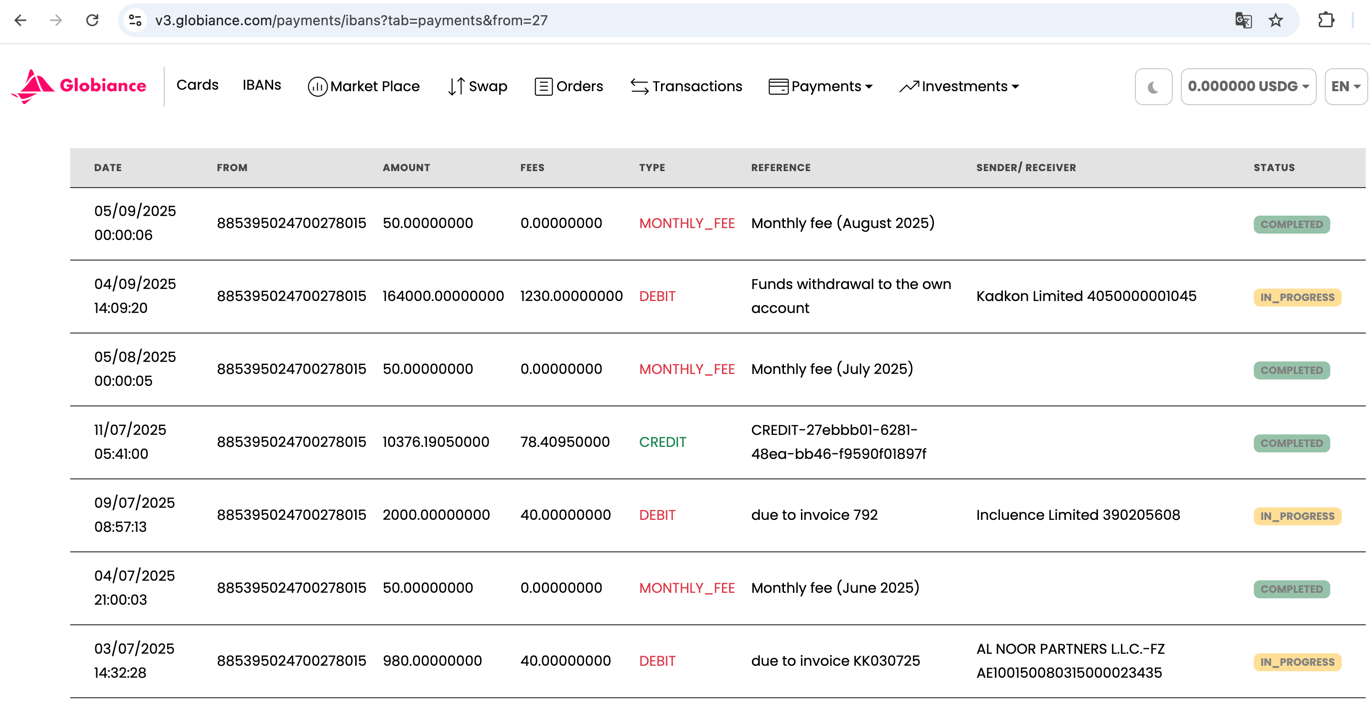

On September 4, 2025, our company Kadkon Limited initiated a withdrawal of $164,000. In the GlobiancePay dashboard, this transaction is still stuck with the status IN_PROGRESS. The funds never reached our account.

Moreover, analysis of the entire transaction history shows that since July 2025 not a single withdrawal request has been executed. Each attempt ended the same way — with the IN_PROGRESS status. At the same time, incoming payments were processed without issues: the system reliably accepted deposits and charged fees.

In other words, the payment gateway works only one way — money can be deposited, but cannot be withdrawn. If the company really had “technical problems” or partner bank blocks, clients should have been warned in advance. In that case, at least no new accounts would be opened, and no new funds would be accepted.

The situation looks like a deliberate simulation of operations: the interface and notifications create the appearance of a working service, but for the key process — withdrawals — the system simply does not function. This fact, combined with the frozen $164,000 transaction, forced us to turn not only to the correspondent bank in Singapore but also to the police to open a criminal case.

Then it became even more interesting. We saw the same data on another domain — v3.globiance.com, which is positioned as a cryptocurrency project. The GlobiancePay login credentials also worked there, and the interface and transactions fully matched. This means that behind the two brands is the same backend and the same team.

It is important to note: our company did not invest in cryptocurrency assets and did not participate in risky “staking” or speculative schemes. We intended to use a regular fiat payment system — to open multi-currency accounts and make international transfers.

The fact that the fiat system login works on the crypto domain v3.globiance.com shows that both projects are run by the same team and owners. The split between “Fiat” and “Crypto” is more of a marketing facade. In practice, it is one and the same product, one database, and one management structure.

Thus, delays with fiat transfers have nothing to do with the “high risks of the crypto market,” but with a direct failure — or sabotage — of the basic payment system.

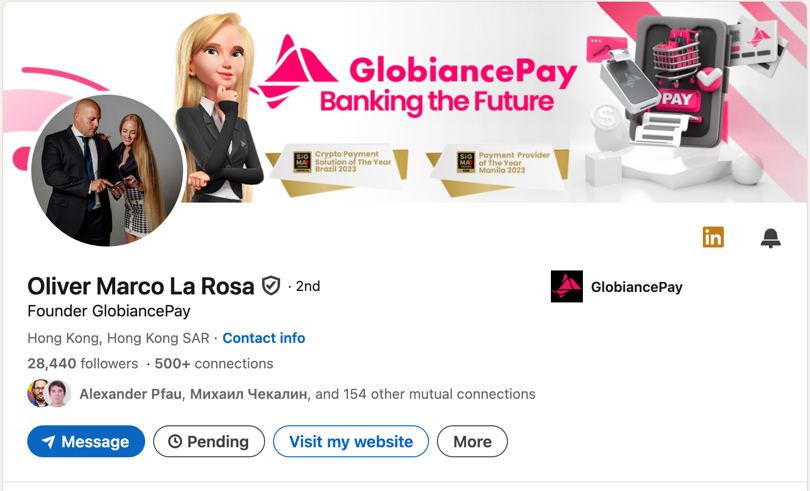

We tried official channels: contacted support, wrote directly to managers, including Oliver Marco La Rosa. Zero reaction. The reply from the Singapore bank contained a simple recommendation: go to the police. This is no longer an internal error — it is a sign that even the bank sees the situation as suspicious.

Meanwhile, in Telegram groups of GlobiancePay, life goes on. Long posts from admins appear regularly: “we conducted a six-month investigation,” “payouts will start in Q3 2025 for some groups,” “full access will be restored in Q2 2026.” Sounds familiar? Exactly like Africrypt or OneCoin — feeding promises to keep clients calm and prevent them from making noise.

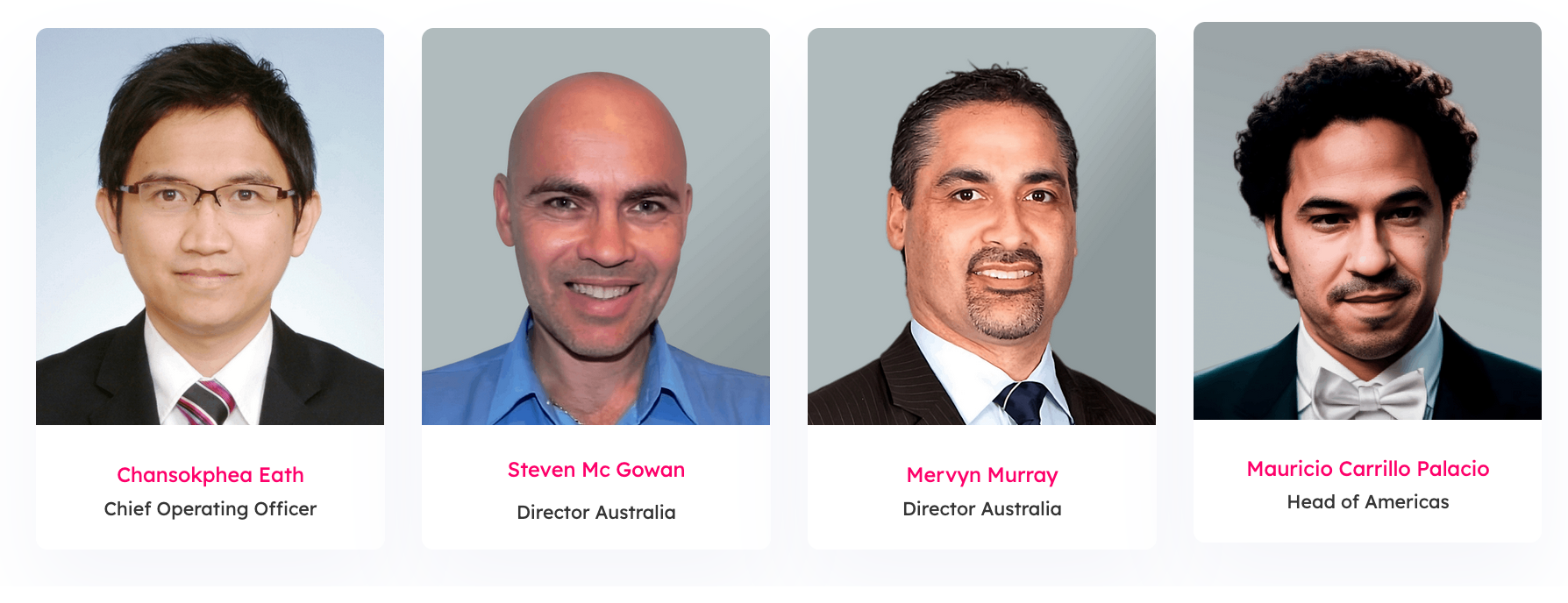

Chat admins like Mauricio Carrillo repeatedly assure that “information has been passed to Oliver La Rosa” and that “a reply is coming soon.” In reality — no contact and no specifics ever came. Their role is to simulate support: keep clients waiting, promise feedback, and buy time.

It is telling that even employees listed in the support system replied evasively for weeks and then admitted that they “only handle SEPA” and have nothing to do with blocked withdrawals or crypto. Four weeks of waiting — and in the end an admission that no help would come.

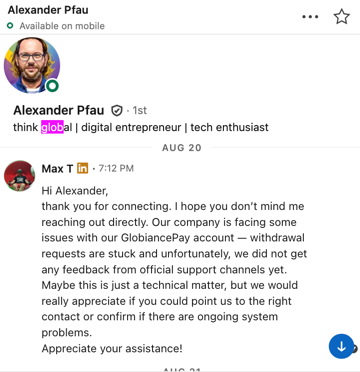

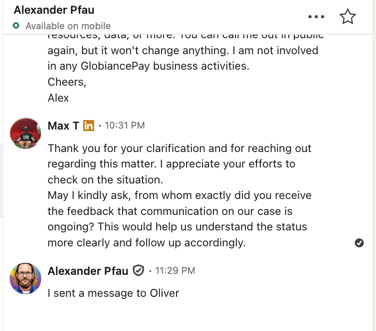

Even technical specialists like Alexander Pfau on LinkedIn confirmed that they “sent a message to Oliver,” but nothing went further. Responsibility is blurred, contacts are blocked, and no one takes action.

This is a system of “buffers” and “filters,” designed not to solve problems but to delay an open scandal. And while we are being fed promises, the money remains in their hands.

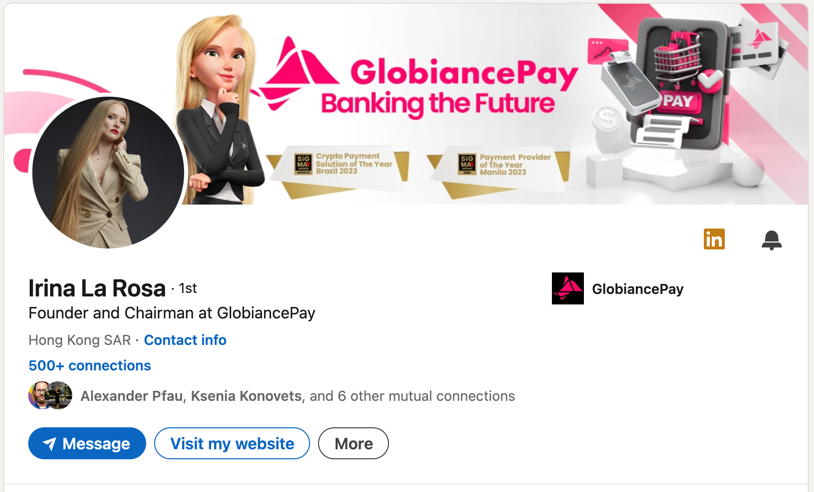

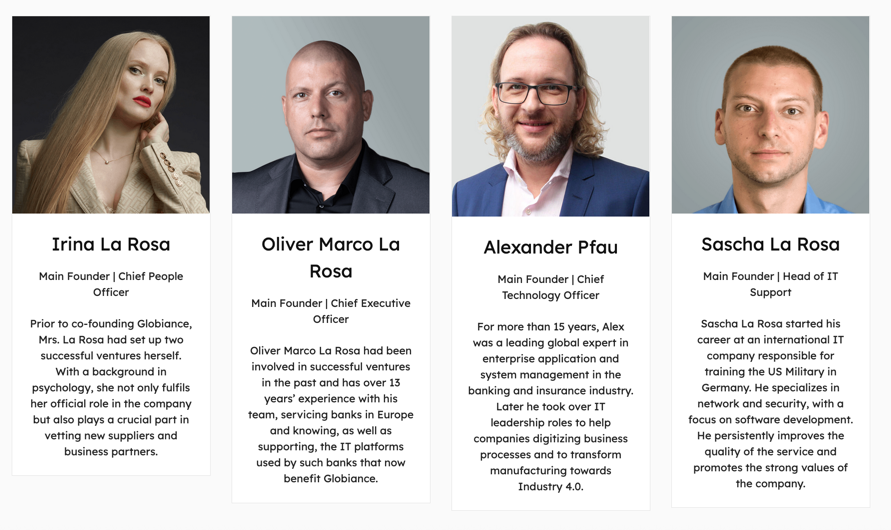

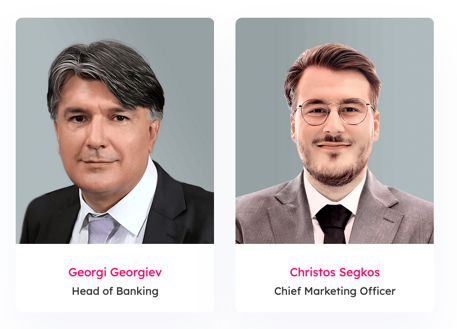

Public profiles of key project figures are easily found on LinkedIn.

LinkedIn profile Oliver Marco La Rosa

LinkedIn profile Irina La Rosa

LinkedIn profile Georgi Georgiev

LinkedIn profile Alexander Pfau

LinkedIn profile Mauricio Carrillo

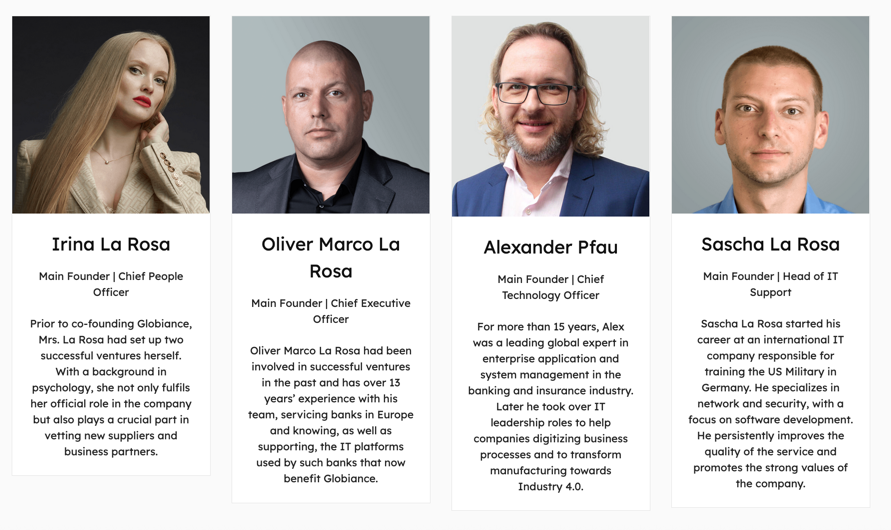

Oliver Marco La Rosa, Irina La Rosa, Georgi Georgiev, Alexander Pfau, Walaiphon T. — they do not hide their roles. Moreover, until recently, the official website had a full “Team” page, proudly claiming “150+ employees worldwide.” Today this page has been removed, but it can still be found in the web archive. And there — the photos and job titles of the very people who now prefer to remain silent.

LinkedIn, however, shows another picture: Globiance and GlobiancePay together have fewer than 50 employee profiles. No “150+” anywhere near. Clearly, the claims of a large international structure were part of a marketing legend — one that has now backfired.

The picture is classic. There is a fiat project and a crypto project, but the team and owners are the same. There are clients who wanted to use a regular payment service but ended up trapped with frozen transactions. There are employees who keep posting in chats and pretend “everything is under control.” And there is silence from the leadership, which in such stories almost always ends with an attempt to disappear.

We are not claiming that all these people have already committed a crime — the final word lies with investigators and the court. But practice shows: when police start asking questions, it is not only the owners who must answer. Responsibility can easily fall on accountants, technical staff, and coordinators who “were just doing their job.” That is why it is important that their names and roles remain public. So that the companies they may join tomorrow know — these people were part of a project that froze client funds and went silent.

Our conclusion is simple: this story has already gone beyond the scope of a commercial dispute. We have frozen withdrawals worth hundreds of thousands of dollars, the bank directed us to the police, the leaders ignore inquiries, and traces on the website are being erased. This is not a mistake. This is a scheme. And the longer it continues, the more people will lose their money.

Detailed Investigation

A comprehensive independent analysis of Globiance’s corporate structure, regulatory status across 15 jurisdictions, and blockchain transaction patterns has been conducted by industry researchers. The findings confirm systematic fraud indicators consistent with known schemes.

📊 Read the full report: Globiance/GlobiancePay: Analytical Report on Signs of Financial Fraud — includes corporate registry data, license verification, and legal qualification across multiple jurisdictions.

Precedents and Real Cases (2015–2025)

These cases show that in global practice, similar stories almost always end with criminal cases and real prison terms:

- Wirecard (Germany, 2020) — former CEO Markus Braun arrested, facing up to 15 years in prison; former COO Jan Marsalek remains internationally wanted.

- Payza (Canada/USA, 2018) — brothers Firoz and Ferhan Patel pled guilty; Firoz received 36 months, Ferhan 18 months and forfeiture of $4.5M.

- OneCoin (Bulgaria / international, 2014–2017) — co-founder Sebastian Greenwood sentenced in 2023 to 20 years; Konstantin Ignatov pled guilty and cooperated; Ruja Ignatova is still wanted (FBI “Top 10 Most Wanted”).

- QuadrigaCX (Canada, 2019) — founder Gerald Cotten officially died, but investigation revealed fraud signs; clients lost about $124M.

- FTX (USA/Bahamas, 2022) — founder Sam Bankman-Fried sentenced in 2024 to 25 years in prison for misappropriating $8B; several associates pled guilty.

These examples show a clear pattern: not only the owners are prosecuted, but also managers, accountants, technical staff, and other participants. It all depends on the degree of guilt and responsibility for concealing information: chats, logs, correspondence, and any other evidence of involvement in the scheme are examined.

As usual in such projects, the owners will try to hide. But their employees, consultants, and administrators will remain — and will answer questions from investigators.

Therefore, our advice to Globiance and GlobiancePay employees is simple: save your chats, make screenshots, and keep any proof of your non-involvement. Only then will you be able to show that you were doing ordinary work and had no part in organizing the scheme. Because when the investigation reaches you, guilt can be shifted onto anyone — an accountant, a coordinator, or a developer. And if you have no evidence of your position, colleagues can easily “dump” the blame on you, claiming that you carried out illegal transfers or other fraudulent actions.

The best step you can take right now is to protect yourself and prepare for the fact that in the near future you will likely have to give explanations to the police and investigators.

One Comment

I had a decent amount of crypto stolen from these people also I’d like to file a claim along side you all